You’ll also find savings accounts for kids and specialty savings accounts, such as a Christmas Club account. Savings accounts, certificates of deposit and money market accounts can all be solid options for growing your money, but they aren’t identical. Understanding these three types of accounts and the interest rates they may pay can help you decide which is best for your money.

How money market accounts work

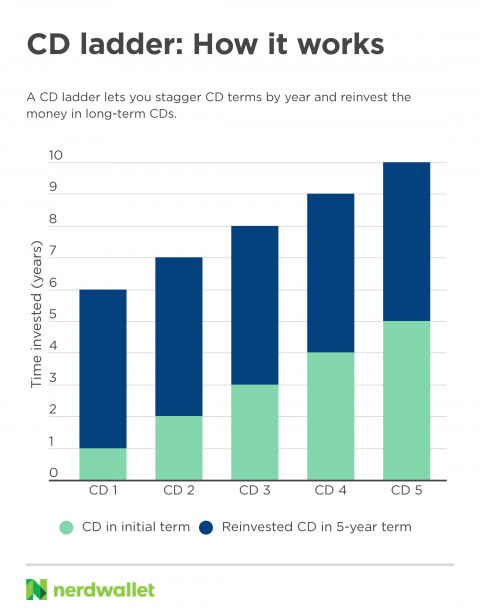

Some CDs allow you to withdraw money whenever you want — though that’s extremely rare, particularly among accounts with the best CD rates. In most cases, you won’t be allowed to make withdrawals until the maturity date, or when your contract is up. Otherwise, you’ll have to pay a penalty for early withdrawal — the amount varies between financial institutions and according to the length of your CD term. invest in cds or money market Account holders earn a higher rate compared to savings accounts — interest compounds differently depending on the bank, though it’s usually daily. However, you may be required to make a larger minimum deposit, and you won’t be able to add more funds once the initial deposit is finalized. You could also employ a CD ladder strategy to balance your need for liquidity with obtaining higher yields.

Pros of Money Market Accounts

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. They are ideal for those with longer-term saving goals who won’t need to access funds in the short run.

Is there any other context you can provide?

- As the name suggests, no-penalty CDs don’t charge a penalty for early withdrawal before the term’s maturity date.

- Treasury securities are essentially interest-bearing IOUs issued by the U.S. government to raise funds.

- Money markets typically have ATM cards and check-writing privileges at certain banks.

- They’re insured by the Federal Deposit Insurance Corp, up to $250,000 per bank per depositor.

If you’re planning for short-term financial goals or need frequent access to your funds, an MMA could be a better option than a CD. CDs are considered low-liquidity investments because they tie up your money until the maturity date. Early withdrawal usually incurs penalties, which can eat into your earnings. You deposit a fixed sum of money for a fixed period, earning a fixed interest rate until maturity. When you purchase a CD, you’re essentially lending money to the financial institution for a specified period of time. Taking money out of a CD before it matures could trigger an early withdrawal penalty, causing you to forfeit some or all of the interest earned.

CDs are time-bound deposits with financial institutions that offer fixed interest rates and are best for individuals who can afford to lock away their funds for a specified term. Generally, though, it’s wise not to exceed insurance coverage limits for an account. You’re covered up to $250,000 per depositor, per account ownership type, per financial institution at banks by the FDIC and by the NCUA at credit unions. While the rates paid by savings accounts, CDs and money market accounts are not tied directly to this rate, they are influenced by its changes. The current minimum opening deposit is $1,000 across all options, but none allow additional deposits after the CD is purchased. That liquidity is the principal advantage of a money market account.

High inflation and high oil prices put a dent in market returns in the 1970s. The market grew but only generated average annual returns of about 4%, well below the market’s lifetime average annual returns. When choosing a CD, remember that you don’t have to go with the financial institution you currently bank with.

Money market accounts are invested differently than certificates of deposit. MMAs are similar to savings accounts, with variable interest rates and good liquidity. CDs usually have fixed interest rates and may yield more interest over time, but you have to wait until the CD matures to access your deposit without incurring a penalty.

But if you’re saving money for a down payment on a home that you plan to buy in a couple of years, a CD could be a good fit. The rate you earn with a savings account can depend on what type of savings account and where you bank. If you open a savings account at a traditional brick-and-mortar bank, your interest rate will likely be lower.

Shop around and compare the deals in your area, and keep an eye out for promotional offers that may help you lock in a higher yield. While this was great news for people looking to take out an auto loan or mortgage, it might be a red flag if you’re considering getting a CD. With this strategy, you buy CDs over several years, each with the same maturity date. When they all mature at the same time, you gain access to the principal and interest from all of the CDs to pay for your big expense. If you have less money to work with, consider a one-year CD with BMO Alto. There’s no minimum deposit requirement and the rate is a healthy 3.90% to 4.50% APY.

In exchange for the large deposit, banks often offer higher interest rates. They typically offer the same features as retail MMAs, such as higher interest rates than regular business savings accounts and limited transaction abilities. CDs generally offer higher interest rates compared to regular savings accounts, making them a potentially more lucrative option. Every savings article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of savings and banking products. A high-yield savings account is best if you just want to upgrade your traditional savings account to one earning a higher return. A CD is best if you want to lock in a high APY and are OK leaving your savings untouched for a certain amount of time.